Special thanks to Zero, Tim, TheAdvisor, PeaceLoveMusic for feedback and review.

Key Takeaway:

-

The Bitcoin economy, particularly Bitcoin capital markets, saw a rising interest from institutions and treasury managers seeking native Bitcoin income on their BTC holdings. Stacks is strongly aligned with this shift, enabling a trust-minimized Bitcoin economy. In 2025, critical technical breakthroughs were achieved, including self-custodial Bitcoin staking and programmable Bitcoin liquidity.

-

Stacks transitioned from core infrastructure buildout to product-led growth, supported by key partnerships. A major governance restructuring via SIP-031, marked a strategic turning point, positioning Stacks as foundational rails for Bitcoin capital markets.

-

sBTC established itself as the benchmark programmable, 1:1 Bitcoin asset meeting institutional-grade standards.

-

New mechanisms are being introduced to strengthen long-term STX value as Bitcoin capital increasingly deploys onto Stacks.

Table of Contents:

-

Major Protocol Achievements & Upgrades (Satoshi Upgrades and 2025 Roadmap)

-

Ecosystem Growth & Market Metrics

-

Governance & 2026 Outlook

Major Protocol Achievements & Upgrades

(Satoshi Upgrades and 2025 Roadmap)

The 2025 roadmap successfully initiated a renewed focus on Stacks Core, sBTC, and ecosystem expansion.

sBTC: Full Activation and Organic Adoption

The sBTC protocol achieved full bidirectional functionality following its December 2024 launch. Initially introduced with a peg-in-only feature, sBTC peg-outs were enabled in April 2025.

Peg-out functionality allows BTC depositors to withdraw sBTC back to native Bitcoin at a strict 1:1 rate, mirroring the deposit mechanism. This milestone was essential for broader integrations and ecosystem development.

To meet growing institutional demand, sBTC underwent two separate cap (2nd & 3rd) increases in 2025, accommodating custodians and institutions such as Hex Trust, BitGo, Copper, and others.

Following the activation of peg-outs, sBTC inflows accelerated significantly. Cap-3, launched on May 15, was filled in just 2.5 hours, bringing total sBTC supply to 5,000 BTC.

Supply caps were fully removed in September 2025, cementing sBTC’s role as the leading Bitcoin asset on a fully expressive Bitcoin layer that offers Bitcoin-grade security and significantly faster execution.

Later in the year, sBTC was listed on Gate and MEXC, expanding access to millions of users worldwide and deepening global sBTC liquidity.

Technical Performance & Clarity 4

The Nakamoto upgrades introduced in 2024 at Bitcoin Block 867867 marked a major milestone for Stacks, aligning the network with Bitcoin self-custody principles while enabling fast, Bitcoin-secured transactions to activate Bitcoin economy.

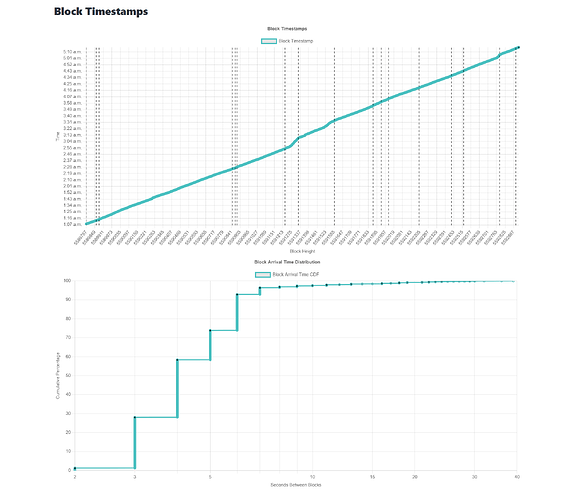

These upgrades ensured consistent fast-block production throughout 2025. Transaction confirmation times on Stacks dropped to under five seconds, while final settlement continued to anchor to Bitcoin. Fast Blocks, a core component of the upgrade, were fully delivered.

Clarity 4 and Dual Stacking were the first major launches delivered by Stacks Labs, the newly established entity under Stacks’ restructured governance framework.

The fourth generation of the Clarity smart contract language launched in November 2025, enhancing security, interoperability, and execution efficiency. These improvements empower developers to build more sophisticated, composable, and secure BitcoinFi primitives.

Dual Stacking significantly increased BTC rewards for both BTC and STX stackers, strengthening Stacks’ economic alignment with Bitcoin. It also lowered the technical barrier for Bitcoin holders to earn BTC-denominated yield.

Tier-1 Stablecoin Launch: USDCx on Stacks

In December 2025, Circle’s USDCx launched on Stacks, introducing institutional-grade dollar liquidity to BitcoinFi. Issued by Circle and fully backed 1:1 by USDC, USDCx is interoperable and enables unified liquidity across the ecosystem.

USDCx unlocks Bitcoin-backed lending and borrowing, safer liquidation mechanisms, non-custodial BTC-collateralized loans, and USDC-powered trading and swaps. From day one, it integrated with ecosystem partners including Bitflow, Granite, Leather, Xverse, Asigna, Fordefi, and Zest Protocol.

Ecosystem Growth & Market Metrics

Developer Activity

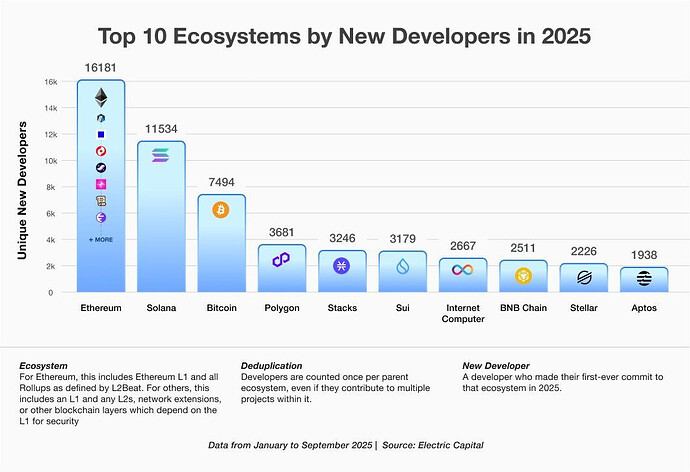

Stacks ranked 5th overall in the Electric Capital 2025 Annual Developer Report, behind Ethereum, Solana, and Bitcoin, demonstrating strong developer momentum and sustained interest in building the Bitcoin economy on Stacks.

Developer growth in 2025 was driven by the focused and strategic efforts of the Stacks Developer Relations team, led by Kenny, Adam, Eric, and facilitated by Stacks Core. The team significantly improved the accessibility, usability, and integration of developer tools, lowering barriers for new and existing builders. Stacks Dev Rel also established a strong presence across both in-person and virtual developer events, while actively supporting developer communities such as Talent Protocol in late Q4 2025. In parallel, multiple Stacks Builder Challenges were organized in collaboration with DoraHacks, further enhancing the overall developer interest and experience.

Together, these coordinated initiatives directly contributed to the strong developer growth observed across the Stacks ecosystem in 2025.

User and Network Activity

-

Proof of Transfer completed 25 stacking cycles in 2025, distributing over 325 BTC in rewards (Stacking Tracker).

-

More than 6.5 million transactions were secured by Bitcoin over the year, with monthly transactions surpassing 1 million in August (Signal21).

-

Active accounts exceeded 225,000, with cumulative unique wallets approaching 1.4 million (Signal21).

-

Transaction volume surpassed 5.4 billion STX (Signal21).

These metrics reflect broad-based network growth and increased confidence among Bitcoin-native builders and users.

Stacks Total Value Locked (TVL)

Bitcoin inflows to Stacks exceeded 5,000 BTC (over $600 million), driven by strong institutional and retail confidence in sBTC. This positions Stacks as the largest Bitcoin-aligned protocol with institutional-grade infrastructure supporting programmable Bitcoin.

Stacks TVL surpassed $160 million in the first half of the year before stabilizing around $115 million. The network nonetheless recorded its highest TVL to date in 2025 across sBTC, STX, USDC, and SIP-10 assets.

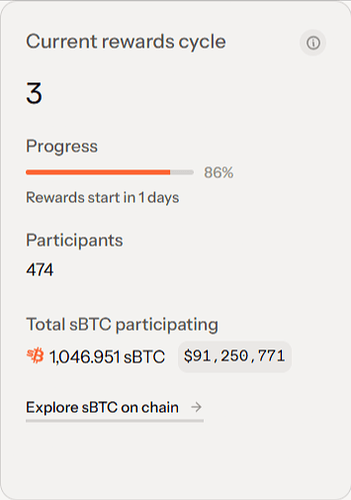

More than 1,040 sBTC are now participating in Dual Stacking, which launched at the end of October.

Top-Performing Protocols

Zest Protocol — Institutional-Grade Bitcoin Credit

With approximately $80 million in TVL, Zest became the largest protocol in the Stacks ecosystem. Over 650 sBTC are supplied, with more than 500 sBTC supplied in 2025 alone, highlighting strong demand for on-chain Bitcoin credit.

STX borrowing utilization reached 91.26%, while the debt ceiling for stSTX was increased from 2.5 million to 5 million STX, reflecting rising demand for STX-backed loans. Zest is preparing to launch Version 2, unlocking new liquidity and enhanced borrowing mechanisms.

StackingDAO — Liquid Stacking

StackingDAO simplified access to all three stacking options, enabling instant liquidity for STX stackers. Users earned an average 9.29% on liquid stacking in 2025 (Stacking Tracker), while protocol TVL surpassed 105 million STX in 2025.

Granite — Bitcoin Lending Without Rehypothecation

Granite offers non-rehypothecated Bitcoin-backed lending with soft liquidation mechanics. TVL reached $22 million, supported by over 120 BTC and $12 million+ USDC supplied. Granite soft liquidation minimizes collateral loss by liquidating only what is required to restore loan health.

Bitflow — Concentrated Liquidity DEX

Bitflow TVL exceeded $6 million, with over $530 million in cumulative DEX volume. As the leading Bitcoin DEX on Stacks, Bitflow is preparing to launch HODLMM, a concentrated liquidity engine currently being tested by professional market makers for big liquidity deployment like sBTC/ USDCx pool. Bitflow was named “Project to Watch in 2026” at the 2025 Stackies Awards.

Hermetica — Yield-Bearing Bitcoin-Backed Dollars and Tokenized Bitcoin Vault

Hermetica’s yield-bearing stablecoin USDh surpassed $6 million in supply in 2025. The team is preparing to launch hBTC, a tokenized Bitcoin vault, in winter 2025. Hermetica was voted Community Favorite Project of 2025 at the Stackies Awards.

Other major contributors to TVL growth include Velar, Alex, and Arkadiko.

Community Tools

Beyond BitcoinFi primitives, 2025 saw the emergence of several ecosystem tools that achieved clear market fit across data, creator economy, identity, and community-driven applications, many of which generated significant on-chain activity.

Data and analytics platforms such as Signal21, Tenero (formerly STX Tools), LunarCrush, and STX Watch played a critical role in providing transparent, real-time on-chain insights. These tools enabled the community to access reliable network data and make more informed trading and investment decisions. Tenero, in particular, reached thousands of daily active users and successfully integrated Stacks token analytics into Dexscreener, significantly improving visibility for Stacks-based assets.

Within the creator economy, Zero Authority emerged as one of the most widely used tools in 2025. It enabled content creators and Clarity smart contract developers to monetize their work directly, earning real BTC and STX on-chain.

As part of its ongoing effort to strengthen community-led governance, the Stacks Foundation announced the launch of a Stacks Improvement Proposal (SIP) Tracker in collaboration with Zero Authority. The early version of this tracker is scheduled to launch in early 2026 and will provide clear visibility into proposal status, governance milestones, upcoming initiatives, and opportunities for community participation throughout the SIP lifecycle.

Stxcity was another impactful creator-focused tool, serving as a launchpad for SIP-10 token creation and distribution. It significantly boosted on-chain transaction activity, particularly during the first half of 2025, while also directly rewarding token creators.

NFT trading activity, primarily driven by the Gamma marketplace, experienced a strong resurgence in the first half of 2025, contributing meaningfully to overall network usage.

Deorganized Media played a key role in expanding the visibility of the Stacks ecosystem across the broader crypto landscape. The outlet provides daily coverage of projects developing in the Bitcoin and Stacks ecosystem, as well as major milestones and events. DeOrganized also covered and drove engagement around Stacks SIPs and governance, including SIP-031, the most significant governance event of 2025. This coverage helped amplify awareness and kept the community better informed about the implications of the proposals and to make informed governance decisions.

BNS One and BoostX also contributed substantially to on-chain activity by facilitating the registration and use of .btc names. These human-readable identifiers simplified the process of sending, receiving, and distributing assets on the Stacks blockchain, with integrations extending to social platforms such as 𝕏 (formerly Twitter).

Community-driven engagement was further strengthened by the rise of several memecoins, including Leo, Welsh, Roo, Not, Flat, and others. These tokens generated high volumes of on-chain transactions and DEX trading activity, fostering participation and social interaction across forums and trading platforms (Signal21).

These developments highlight the growing maturity of the Stacks ecosystem, extending beyond core DeFi primitives into payments, identity, creator monetization, and data infrastructure. As on-chain activity diversifies and new use cases emerge, the foundation is being set for the next phase of adoption. Long-standing ecosystem builders alongside late-2025 standouts, most notably Boom and x042 Stacks, are shaping the future of Stacks. By developing agent-to-agent and human-centric payment rails, these teams are building critical infrastructure that will define how value moves across the network, making them key initiatives to watch in 2026.

DeGrant — Decentralized Grant

DeGrants is a community-driven, decentralized grants program supporting projects across the Stacks ecosystem. Originally designed by Stacks community member HeroGamer, DeGrants successfully completed its 3rd cohort in Q4 2025. The cohort funded and supported a diverse range of innovative initiatives including community and creative projects, developer tools, and DeFi protocols that advance both the Stacks and Bitcoin ecosystem.

The 3rd cohort followed a well-structured and transparent framework, with stewards guiding applicants through the grants process, reviewing proposals, supporting builders and grantees, and ensuring funds were allocated effectively. In parallel, mentors provided hands-on guidance, feedback, and domain expertise to help grantees execute and scale their projects.

Notable recipients from DeGrants Cohort 3 included Stacks AI Guild, Zero Authority, Bitcoin University (BTCU), Stacks Africa, and Melanie Carstens Media continue to deliver meaningful and ongoing value to the Stacks ecosystem.

Governance & 2026 Outlook

Operational Transition

Following community approval of SIP-031, the Stacks Foundation completed a strategic handoff of key operations to Stacks Labs and the Stacks Endowment, allowing the Foundation to focus on governance and community stewardship.

Stacks Labs now leads infrastructure development, developer support, and ecosystem growth, with a mandate to activate hundreds of billions of dollars in Bitcoin capital and scale a global Bitcoin economy.

Stacks Endowment manages a long-term, performance-driven treasury to fund grants, liquidity, key integrations, and DeFi investments, in collaboration with the Stacks Treasury Committee, which provides oversight, community input, and high-level budget guidance.

Stacks Treasury & 2026 Budget

In December, the Stacks Endowment held its first formal meeting, with the Treasury Committee in full quorum. The committee reviewed SIP-031 progress, approved the 2026 ecosystem budget, and aligned on long-term treasury strategy and vision.

A $27 million operating budget was approved for 2026, primarily allocated to core engineering and security, network growth, and ecosystem working capital. The budget reflects macroeconomic conditions, the crypto market environment, and Stacks’ strategic positioning alongside Bitcoin.

2026 Roadmap and Beyond

Stacks is focused on becoming the default Bitcoin rails, bringing Bitcoin’s growth, activity, and capital back onto the Bitcoin network itself without compromising security, custody, and sovereignty.

The roadmap emphasizes scalability, privacy, and programmability while maintaining Bitcoin-grade safety guarantees. At its core, Stacks enables native BTC-denominated yield with minimal trust assumptions and always-available unilateral exits.

Key Focus Areas beyond Bitcoin Staking

-

Fast, scalable, low-cost Bitcoin payments that feel instant in everyday use

-

Privacy-preserving transactions with user-controlled selective disclosure for compliance

-

Deep institutional liquidity and global integrations

Self-custodial Bitcoin staking and minting, and Bitcoin-denominated yield via sBTC remain Stacks’ core differentiator. Beyond this, Stacks will continue advancing scalable payments, compliant privacy, trust-minimized BitcoinFi, and continuous UX and network upgrades to deliver a seamless experience for Bitcoin holders at global scale.