Hi Stackers,

This proposal explores changes to the Stack economic model that, if implemented, expand Bitcoin activity on Stacks and ensures that Stacks accrues value as the network grows. Let’s dive in.

Bitcoin will be around 100+ years from now. The Bitcoin L2 that is the default rails for BTC payments and Bitcoin DeFi activity needs to be around 100+ years as well. Stacks is currently the leading contender to be that default Bitcoin rail, and we need to start thinking about how the Stacks protocol generates revenue and self-sustains for the coming decades.

As more Bitcoin is deployed and used on Stacks, some of the value from that activity should directly accrue to STX. Several protocols in crypto generate fee revenue, typically in their own native token. Stacks is unique as it’s primarily designed for using Bitcoin (sBTC), which means people are bringing external capital (their bitcoins) to the network and using it here. If the Stacks network is useful to these bitcoin users, then they’d happily pay some fee to use the network.

The Stacks token economics and value accrual should be designed in a way that more use of Bitcoin (sBTC) on the network automatically makes Stacks more valuable and rewards the STX holders who run validators and signers. Stacks L2 can become self-sustainable this way.

Stacks (via sBTC) has the potential to bring in millions of users and huge amounts of BTC through better UX, faster/cheaper transactions, and a native yield (hold Bitcoin, earn Bitcoin) that nobody else can. In addition to how sBTC is already being used on Stacks, there are three big upcoming use cases for sBTC on Stacks:

- Native Bitcoin Staking – Bitcoin users can hold bitcoin and earn yield directly in bitcoin, via dual stacking and modular BTC yield vaults on Stacks.

- Institutional Bitcoin DeFi – Institutions holding large amounts of bitcoin can put their bitcoin to work and participate in Bitcoin DeFi as Stacks iterates towards more trustless and self-custodial architecture that allows minting sBTC from segregated custody addresses.

- Fast Bitcoin Payments – Bitcoin users can experience a simplified UX where they can pay sBTC transaction fees in sBTC, while iterating towards self-custodial models for sBTC.

These upcoming use cases should reinforces demand for STX while making Bitcoin capital more productive. If we make the right protocol design upgrades today then as sBTC usage takes off STX value accrual can be automatically taken care of. The economic upgrades should result in a flywheel where as protocol revenue goes up with increased sBTC use, STX becomes more valuable. The time to make these economic changes is now given first version of sBTC just went live and we already have 3,000+ BTC deposited.

Overview: The Bitcoin Liquidity Thesis

Stacks is the leading Bitcoin L2. It enables fast, cheap transfers of bitcoin and makes bitcoin programmable in L2 smart contracts. Stacks is the only protocol native to the Bitcoin ecosystem (secured by 100% Bitcoin hash power) with a native BTC yield mechanism.

sBTC, the 1-1 Bitcoin token on Stacks, is poised to lead the market as a programmable Bitcoin asset. As billions in BTC value flows to the L2 and becomes productive via sBTC, Stacks accrues network value as well.

Stacks wins by becoming the Bitcoin Liquidity Layer, offering decentralized, trust-minimized Bitcoin yield via PoX and programmable yield vaults built on top of sBTC.

Bitcoin is pristine collateral, but according to Bitcoin Layers, only 1% of BTC is currently deployed in Bitcoin-native protocols. The rest is sitting idle in cold storage or centralized services. Stacks can change that.

Why Now?

- There is strong user demand for Bitcoin-native yield, which has been validated through user research studies, and evident by the success of the sBTC rewards program. Throughout the industry we have also seen the rise of new institutional offerings such as the Coinbase Bitcoin Yield Fund and new protocols like Babylon gain rapid traction with BTC locked for yield.

- Stacks’ Proof of Transfer uniquely enables a sustainable, native BTC yield without bridges or intermediaries. This mechanism is battle-tested and offers a reliable and scalable foundation for BTC-native yield products. The BTC yield is unique to Stacks, where as other protocols offer yields in their (non-BTC) tokens.

- The Bitcoin chain that aggregates yield-generating BTC will dominate BTC DeFi. As more users and institutions seek productive uses for idle BTC, the L2 that can aggregate that liquidity while preserving Bitcoin’s trust model will become the de facto financial layer. Stacks is well-positioned to lead here: it combines strong Bitcoin alignment, a maturing DeFi ecosystem, and a roadmap toward fully trust-minimized sBTC. Capital tends to concentrate where it can earn the highest sustainable return with the least risk — and that’s what Stacks is building.

The rest of this post outlines a series of upgrades and features that will best position Stacks to win this category.

1. Unlocking Bitcoin Yield on Stacks

Dual Stacking: Aligning BTC and STX Incentives

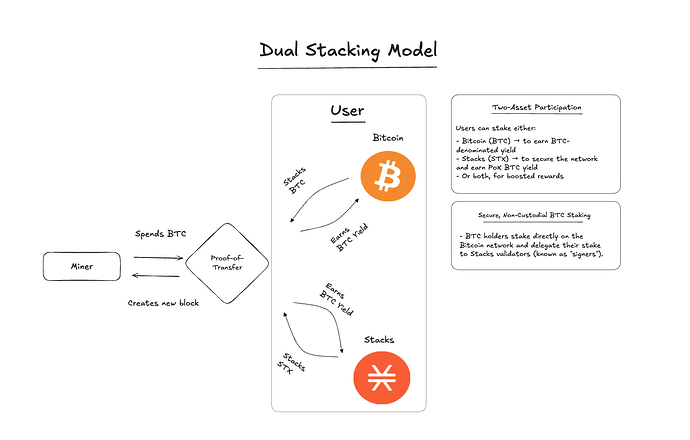

Dual Stacking is a mechanism that would allow users to stake BTC, STX, or both to earn BTC-denominated rewards via the PoX mechanism. While BTC holders could earn a small base yield by holding just sBTC, by supplementing their BTC holdings with a proportion of STX holdings they will unlock fully maximized BTC earnings.

The Dual-Stacking model is designed to do three things:

- Attract and retain Bitcoin capital through sustainable BTC yield.

- Strengthen Stacks protocol security via Bitcoin economic security.

- Create a sustainable value accrual mechanism for STX.

How it Works:

Users can stake either:

- BTC to earn BTC-denominated yield

- STX to secure the network and earn PoX BTC yield

- Or both, for boosted rewards

Dual Stacking Incentive Model

Dual staking offers a multiplier on BTC staking rewards based on the ratio of STX staked alongside BTC. Higher STX participation results in higher BTC yield tiers.

The exact yields are subject to further economic analysis and would likely be floating rates, but as an Illustrative example :

| Tier | STX : BTC Ratio | BTC Yield Boost |

|---|---|---|

| Base | 0 : 1 | Standard rate (25-50 bps) |

| Level 1 | 5,000 : 1 | (1.5-2x standard rate) |

| Level 2 | 15,000 : 1 | (3-5x standard rate) |

| Level 3 | 30,000 : 1 | 10-20x standard rate) |

Dual Stacking ties together BTC capital inflows, protocol security, and STX alignment. By giving Bitcoin holders sustainable, decentralized yield — and STX holders new utility — we lay the foundation for the next era of Bitcoin applications. This creates a self-reinforcing feedback loop, where people stake STX to maximize their BTC yield opportunities, as demand for STX increases, this supports the yield rate and helps to scale to more users.

In future iterations, staked BTC may be restaked to help secure new Layer 1 networks or Bitcoin subnets, creating a Bitcoin-native economic security layer. These new chains or subnets could compensate Bitcoin stakers through their own native token emissions, turning Bitcoin capital into a source of shared security across chains. This expands Bitcoin’s role from passive reserve asset to active coordination layer.

1.1. Programmable BTC Vaults: Scalable Yield Products on Stacks

Programmable BTC Vaults are plug-and-play Bitcoin yield products built on top of Stacks. These vaults enable users to deposit BTC and earn yield through modular, composable strategies — unlocking a powerful mechanism for scaling Bitcoin-native DeFi.

How it Works:

- Users deposit BTC, which is converted into sBTC.

- That sBTC is routed into vault strategies across the Stacks ecosystem. The ecosystem entities will build or partner with vault deployers to build automated Stacks DeFi vaults.

- Over time, users receive yield directly in sBTC.

These vaults are designed to be fully extensible — offering “BTC in, yield out” simplicity for both retail and institutional users. Future versions may include the ability to borrow against BTC to access real-world yield opportunities, or other fixed-income products.

Why it Matters:

By creating a single, one-click option it will streamline access for Stacks DeFi protocols, remove friction for investors and offer a complete flywheel to earn Bitcoin yield, which also serves to bootstrap institutional and retail DeFi activity on the Stacks network.

Taken together, when you combine the native yield from dual-stacking, plus additional simplified opportunities across the ecosystem, the result is the best platform to earn real Bitcoin yield, which will aggregate liquidity on Stacks. This is a critical first step that will allow Stacks to scale to more users and enable new use cases in the future.

2. Protocol Revenue: Simplifying UX and Aligning STX Value Capture Through Fee Abstraction

In short: Cement the value of STX as a gas token, while enabling better user experience.

One of the UX barriers for Bitcoin holders using sBTC is the requirement to hold and use STX for transaction fees. For a Bitcoin-native audience, the need to acquire and manage a separate token just to move BTC is unintuitive and adds friction during the onboarding step. If we want to reach millions of Bitcoin users, we must meet them where they are — with an experience that feels native to BTC.

Fee abstraction offers a powerful solution. Under this model, users have the option to pay gas fees directly in sBTC. Behind the scenes, the protocol automatically converts those fees into STX, paying the actual transaction fee to the miners while capturing the additional fee as protocol revenue.

This preserves the integrity of the Stacks economic model (STX remains the underlying gas token) while unlocking a smoother user experience. Developers gain the freedom to build wallets and apps that feel Bitcoin-native, while the underlying protocol mechanisms continue to drive demand for STX through every transaction.

How It Works:

- User pays transaction fee in sBTC.

- Protocol converts sBTC to STX under the hood (e.g., via sponsored tx or onchain DEX).

- STX is still used at the protocol level to fund execution and security.

This could be implemented as a “buy-back and burn” model where sBTC transactions include a premium, and that revenue is used to buy and burn STX — effectively removing that STX from circulation. Alternatively, such protocol revenue can be directed to a Stacks treasury for accelerating growth of the ecosystem long-term.

Why it Matters:

Long-term, removing UX barriers will increase the transaction volume on Stacks and increase STX value accrual. This simplified onboarding flow will enable more seamless experiences in Stacks DeFi, helping teams acquire users and remove friction as they interact across the ecosystem.

3. Expanding Institutional Access: Upgrade sBTC to be Compatible with Qualified Custody

Another key unlock for sBTC adoption lies in onboarding institutional users. Stacks is uniquely positioned to serve this audience due to its long track record, performance, and long-standing institutional support.

The Problem:

Today, many institutional investors who are eager to access Bitcoin DeFi on Stacks are unable to participate onchain due to compliance and fiduciary constraints. In particular, they require qualified custodians not just for the sBTC, but also for their underlying BTC that was pegged in.

The Solution:

To meet this demand, Stacks can introduce support for an institutional ****sBTC custody model. In this framework, regulated custodians are able to mint sBTC by depositing BTC into a 2-of-2 multisig between the custodian and the sBTC signer set. The user’s BTC never has to leave their custody. Instead, the process is verified through smart contracts that mint standard, fungible sBTC and uses presigned transactions to maintain the sBTC account balance. Importantly, this approach preserves a unified sBTC token. Whether sBTC is minted via the the normal path or through a regulated custodian, it remains indistinguishable on-chain. This ensures deep liquidity and seamless usability across the Stacks DeFi ecosystem.

Why it Matters:

This approach unlocks institutional capital by enabling compliant BTC participation via regulated custodians. This allows us to unlock billions in Bitcoin capital with institutional investors, many of whom have never before participated in the onchain Bitcoin economy.

This enables rapid distribution growth, while we build toward a more trustless system over time.

3.1. Trustless Evolution of sBTC

As sBTC adoption grows, the evolution of the protocol should continue to reduce trust assumptions while preserving composability and usability. Today, core developers are researching and modeling evolving sBTC towards a fully non-custodial, trustless Bitcoin asset where users retain unilateral control over their BTC when they hold it as sBTC in their wallet and use it for payments and other use cases. This model is an improvement for all users, in particular those who demand stronger guarantees rooted in Bitcoin’s core principles of security and decentralization.

Conclusion

Stacks is uniquely positioned to become the liquidity layer for Bitcoin.

By combining native BTC yield, seamless UX, institutional onramps, and further trustless optimizations for sBTC, we’re building a system that aligns with Bitcoin’s values while expanding its utility.

Every piece of this strategy is designed to reinforce STX as the core asset powering the Bitcoin economy on Stacks. Yield, scalability, composability, and capital access all converge here — creating a platform capable of onboarding millions of users and billions in Bitcoin.

The path forward is clear: deliver better tools, reduce friction, and align the growth of BTC on Stacks to the value of STX. That’s how we grow — and that’s how Stacks wins.