As the Nakamoto upgrade is going live there is a timely proposal that requires attention from the Stacks community.

STX halvings occur every 4 years like Bitcoin, however the current software implementation uses Stacks blocks to approximate the Bitcoin halving (instead of Bitcoin blocks). This has led to a drift over time as not every Bitcoin Block has a corresponding Stacks block. Therefore, instead of halving exactly with BTC, the STX halving will likely occur in Dec 2024 (not synced with BTC halving).

Because of this, the upcoming halving will cut the incentives for miners and signers by 50%, right after the Nakamoto launch and sBTC is launching. These two launches are the most significant upgrades to the network and changing the incentives and economics for network participants at a time that the network is already going through updates could have negative consequences for the growth and decentralization of the Stacks blockchain.

To summarize: We don’t want to change the system while the system is changing.

Aligning STX halvings with BTC halvings will not only strengthen the connection the Stacks L2 has to Bitcoin, but also synchronize the economic adjustments of both assets, reducing changes in incentives for miners and signers at each halving.

Finally, from previous community discussions, it’s clear that maintaining the current Year 2050 total supply of 1.818B STX is something we’re all aligned on, and so any adjustment to the schedule needs to achieve that as well.

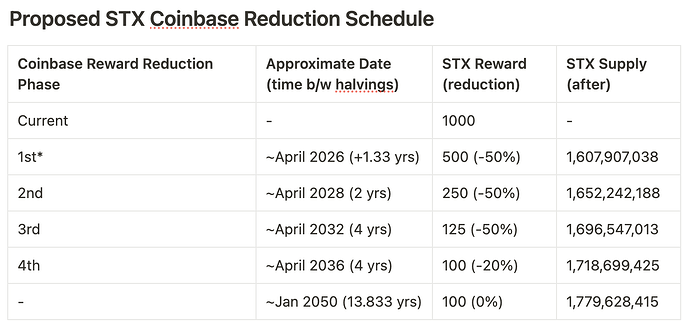

Below is a proposal that achieves these three goals:

(a) Align Stacks halvings precisely with the Bitcoin halvings, by linking Stacks halvings to Bitcoin blocks instead of Stacks blocks

(b) Ensure that adequate incentives are available to miners and validators/signers right after Nakamoto and sBTC launch. Maintaining adequate incentives is especially critical to the security and decentralization of the network at the early bootstrapping days of sBTC.

(c) Ensure that the year 2050 supply of 1.818B does not change.

Below are the full details on the proposal and the timeline

Proposal Details

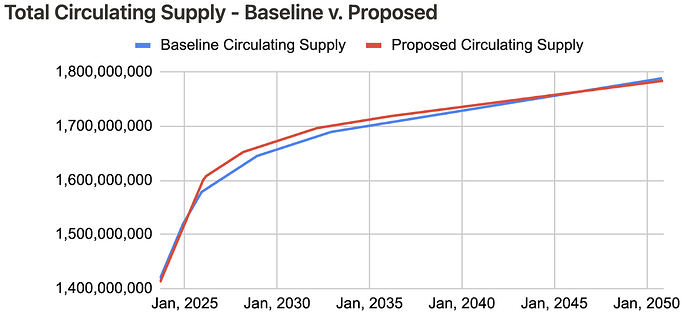

Projected Supply Impact

As a result of these proposed changes, the projected STX supply in January 2050 will be 1,779,628,415 STX, which is less than the current projection of 1,783,063,600 STX and well below the widely accepted 2050 supply cap of 1.818 billion STX.

Next Steps

This proposal is both time-sensitive and critical for the future of Stacks, requiring broad community consensus to move forward. Given its impact on all STX holders, the activation bar will mirror the rigorous requirements of previous major hardforks like Stacks 2.0 (SIP-015) and Stacks 3.0 (SIP-021).

Three key criteria must be met to signal sufficient support for this SIP, representing Stacked STX holders, non-Stacked STX holders, and miners. This inclusive approach invites all participants, even those who do not typically Stack, to vote—broadening participation beyond past practices.

Voting Timeline

Voting will take place during reward cycle 97, estimated to begin on November 11, 2024, and end on November 26, 2024. This window ensures that any decision made can be implemented before the originally scheduled halvening on December 27.

For Stackers

To activate this SIP, the following voting conditions must be met:

- The total amount of Stacked STX participating in the vote must be at least double the amount locked by the largest Stacker in the previous cycle, to ensure no single entity dominates the vote.

- Of the the participating Stacked STX, at least 80% must vote in favor (“yes”) for the SIP to be approved.

This voting process is iterative, and feedback from the community will help refine the process for future decisions. Not voting will be considered an acceptance of the final outcome, whichever way the vote goes.

Deadline for Consensus

A SIP vote should be finalized by December 7, 2024, allowing node operators sufficient time to implement the necessary updates before the December 27 halvening. Delaying this halvening is essential to prevent disruption to Nakamoto signers and sBTC liquidity while ensuring the long-term supply goal of 1.818 billion STX by 2050 is maintained.

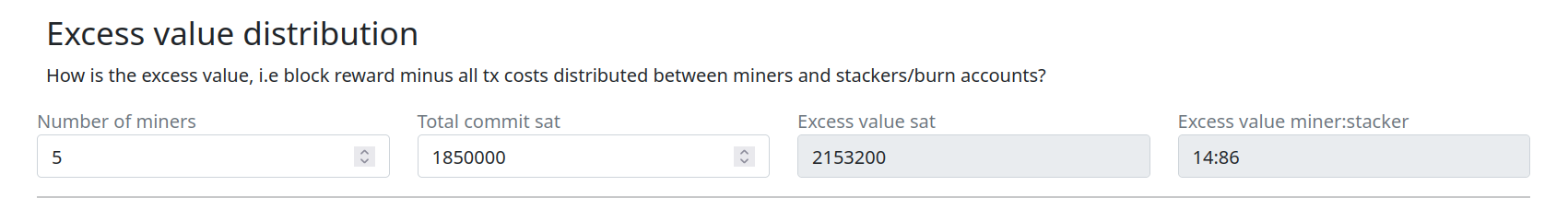

. Rewards per slot would go from 976,633 sats to 466,407 sats at the current sats/stx price.

. Rewards per slot would go from 976,633 sats to 466,407 sats at the current sats/stx price.