Hi Builders, Stackers, and Community members,

This post is for you on behalf of the DeFi WG. Earlier this year, we started a process for How Stacks Wins with Community Calls + open Roadmap Feedback. Here’s what we’ve cooked.

How Stacks DeFi Wins and Builds the Bitcoin Economy with Strategic Capital Deployment

TL;DR: Stacks is positioning itself as the trusted source for Bitcoin yield — the best place for anyone to earn BTC yield with simplified, user-first DeFi products. This nine-month strategy (May 2025–Jan 2026) leverages strategic capital deployment, robust ecosystem incentives, and coordinated media outreach to target $1B+ in TVL and cement Stacks as the leading layer for Bitcoin-native DeFi. The focus: sustainable growth, measurable adoption, and building the strongest foundation for the Bitcoin economy.

A strong DeFi strategy is central to expanding and strengthening an ecosystem. For Stacks, growth is the core objective. Over the next nine months-from May 2025 through January 2026-the ecosystem will focus on a streamlined, user-centric approach designed to accelerate its position as the leading layer 2 for Bitcoin DeFi. The aim: deliver measurable ecosystem expansion, broader adoption within the Bitcoin economy, and a clear path to becoming a $1B+ ecosystem.

How Other Ecosystems Are Growing

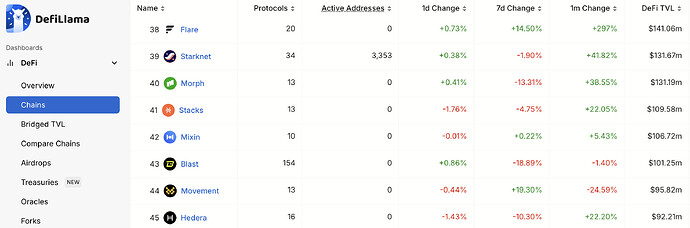

Assessing Stacks’ current position is the first step in identifying the best path forward. Currently, STX is ranked approximately #41 on DeFiLlama, with a TVL of ~$110M as of May 2025.

For context, L2s like Sonic and Sui have achieved TVLs above $1B by aggressively incentivizing liquidity and supporting new protocol launches. While Stacks currently ranks #41, this highlights both the scale of the opportunity ahead and the proven effectiveness of these strategies. With focused capital deployment and ecosystem coordination, Stacks is well-positioned to accelerate growth and follow a similar trajectory.

Paying close attention to capital deployments, treasury mechanisms, sustainable DeFi protocol development, and other market readiness cues will unlock the flywheel that creates long-lasting growth. These levers help Stacks capture new opportunities and position itself as a leading force in Bitcoin DeFi.

![]() Here’s the playbook for 2025, inspired by successful strategies from fast-growing DeFi ecosystems.

Here’s the playbook for 2025, inspired by successful strategies from fast-growing DeFi ecosystems.

A Strategy of Show, Don’t Tell

Why Capital Deployments Matter

Total Value Locked (TVL) is more than a vanity metric - it’s a signal that tells the market there’s momentum within a DeFi ecosystem. High TVL indicates active liquidity and tangible opportunity, which in turn draws in users, developers, and additional capital.

DeFi primitives-such as lending, borrowing, and liquidity pools-are the bedrock for the ecosystem, spurring protocol growth and enabling network effects to take off.

By strategically deploying treasury funds to support builders and decentralized applications, the community can shift from short-term problem solving for DeFi into a hub for growing the broader Bitcoin economy. This evolution, which began as a DeFi Working Group, can now focus on leveraging every available resource to maximize the impact of capital across the network.

Adopting a more deliberate approach to capital activation allows the Stacks ecosystem to prioritize initiatives that drive sustainable growth. In the coming months, this strategy will support targeted liquidity infusions, incentivize new protocol launches, and help ensure that core DeFi infrastructure remains robust and accessible.

These efforts are designed to set the stage for the next wave of innovation and adoption within the Stacks and Bitcoin ecosystems.

Building a Sustainable DeFi Economy - the first 250mm tvl

Increasing total value locked is an important aspect of the strategy, but it isn’t the ultimate goal. The real mission is to cultivate an active, resilient, and sustainable Bitcoin economy on Stacks. Achieving this requires a thoughtful approach and a focus on long-term growth. In the near term, building this strong foundation involves:

1) DEX Depth (targeting $20mm+, in progress)

With DEXs being the rails of any DeFi system, incentivizing trading pairs for cornerstone assets is critical, to enable onchain swaps with minimal slippage. Critical pairs include STX/sBTC, STX/aeUSDC, and aeUSDC/USDh.

Additionally, introducing a Uniswap v3-style DEX upgrade (via grants) with our existing DEXs Bitflow, Velar, and ALEX will dramatically increase the efficiency of ecosystem liquidity. Concentrated liquidity enables capital to work harder, making it possible to achieve more with less.

2) Market Makers (in progress)

As baseline DEX liquidity firms up, another component is onboarding on-chain market makers to help manage spreads and depth across the DEXs for significant assets (STX, sBTC, aeUSDC, etc.). They will play an essential role in growing the Stacks economy. One is currently onboarding. Market makers will not only manage spreads & liquidity across the DEXs, they will be farming across DeFi apps, creating more activity overall.

3) Institutional LP Capital (targeting sBTC + stablecoins, $50mm+)

A continued focus on bringing in liquidity providers through LP brokers will help the ecosystem hit a goal of increased TVL and usage for Stacks DeFi dapps like lending protocols, swaps, AMMs, and external bridges (Allbridge, Axelar (wip), Another tier 1 bridge (wip)).

At the end of the day, it’s important to promote usage of Stacks apps and to do so, early suppliers, borrowers, and swappers from trusted institutions will need to be bootstrapped. With flexible terms and performance-based rewards, short-term liquidity can be ensured while creating the foundation for long-term growth.

4) dApp Incentives (targeting $1mm+, in progress)

A critical budget of at least $1mm is now effective to allow DeFi apps to apply and receive incentives that can be used to boost yields across protocols for user acquisition efforts. This plan directly ties to the overall goal of helping the ecosystem grow. By bolstering projects to achieve their roadmap goals, showing growth, and ultimately bringing more users to the Stacks DeFi ecosystem, the flywheel begins to pick up speed on its own. Larger incentives to come post first milestone of 250mm.

5) CEX SIP 010 Support (in progress)

As sBTC’s centralized exchange support is developed, support for the full SIP 010 token standard is being included. Being ready for the next wave of adoption for many protocols actively planning their Token Generation Events (TGEs) is critical. This will create a simpler and more efficient structure for projects to successfully TGE.

6) DeFi Media Roadshow

To maximize user acquisition and ecosystem visibility, coordinated media outreach is being prioritized to highlight why Stacks DeFi stands out across all chains. The goal is to provide DeFi teams with the marketing support they need for successful podcast appearances, mainstream media bylines, and memorable press coverage. By structuring these campaigns around targeted media tours, broader awareness can be driven and Stacks DeFi positioned as a leading opportunity in the decentralized finance landscape.

The Flywheel in Action

Here’s what the roadmap looks like when capital is deployed strategically:

- Seed DEXs → Attract early liquidity with sBTC & stables

- Activate Protocols → Lending markets, Bitcoin-backed stables, perpetuals and liquid staking options that drive protocol revenue

- Incentivize Usage → Boost yields, encourage trading, drive inflows.

- Signal Momentum → TVL aggregator rankings climb, DeFi media roadshow, attracting LP interest.

- Protocols Raise Capital → Higher FDVs for protocols = more TVL.

This is the TVL flywheel.

Stacks can do it too - but only if action starts now.

Why This Strategy Wins

Stacks holds a distinct advantage: it is Bitcoin-native, smart-contract enabled, and powered by a dedicated builder community. What’s needed now is coordinated capital to unlock its full potential.

With the right strategy, Stacks is poised to become the first layer that comes to mind for investors seeking to earn Bitcoin yield. The ecosystem’s focus is on building toward a future where Stacks is recognized as the trusted source for BTC yield, delivering the most accessible and simplified DeFi products-both existing and new. The mission is clear: to make Stacks the default destination for investors ready to put their Bitcoin to work.

This isn’t about chasing hype-it’s about building a genuine Bitcoin economy, underpinned by real liquidity, rapid protocol development, and strategic capital deployment.

This is the road to a $1B+ Stacks ecosystem-unlocking new opportunities for builders, users, and investors across the Bitcoin economy.

The roadmap is clear. The protocols are ready.

Let’s move forward. Let’s win.

-Rena