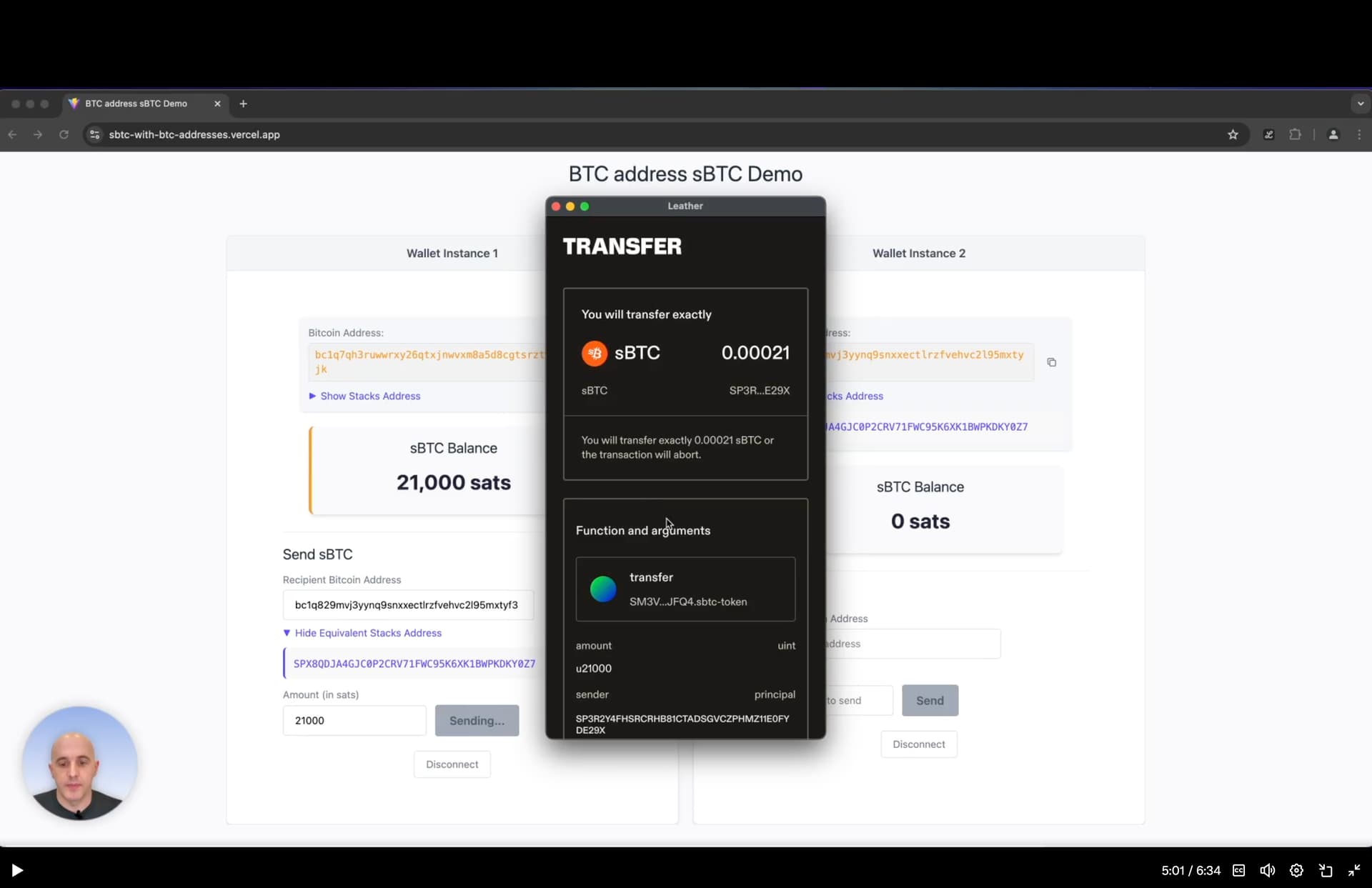

Perhaps there could be more tax clarity if Stacks went further then what LN does: instead of sBTC having a separate Stacks address, it is has native segwit bitcoin addresses (per L Salibra) and keeps the symbol BTC when bridged. sBTC is not needed and just makes it look like wBTC, cbBTC et al.

LN does a good job of keeping BTC looking like BTC even though it is lnBTC. The wallet would handle the logistics out of sight of the user and also show this BTC as another address alongside their L1 BTC. The wallet would block L2 BTC from being sent accidently to an L1 address without including the peg out to L1 as part of the process.

I think LN would have been better off not having a separate address system. Maybe segwit was not available in the early design stage?

Would change of the symbol sBTC to BTC make favorable tax treatment more likely? Probably.

The IRS is clear that wrapping taxable. Here’s a pretty good AI breakdown of current understanding.

Thought Process from AI

Answer:

The tax treatment of moving BTC to Stacks’ Layer 2 (sBTC) is not definitively settled by the IRS, but based on current guidance and technical details from the search results, here’s the analysis:

Key Factors

- sBTC’s Design:

- sBTC is a 1:1 Bitcoin-backed asset on Stacks, designed to enable decentralized movement of BTC between Bitcoin L1 and Stacks L2 (Stacks FAQ).

- Unlike custodial wrapped BTC (e.g., wBTC on Ethereum), sBTC is non-custodial, meaning users retain control of their BTC during the process (sBTC.tech).

- IRS Guidance:

- The IRS generally treats crypto transactions as taxable if they involve a disposition (e.g., selling, exchanging, or transferring to a new asset).

- Custodial wrapping (e.g., BTC → wBTC) is widely considered taxable because it creates a new token. However, non-custodial bridging (like sBTC) is less clear.

- Perception vs. Reality:

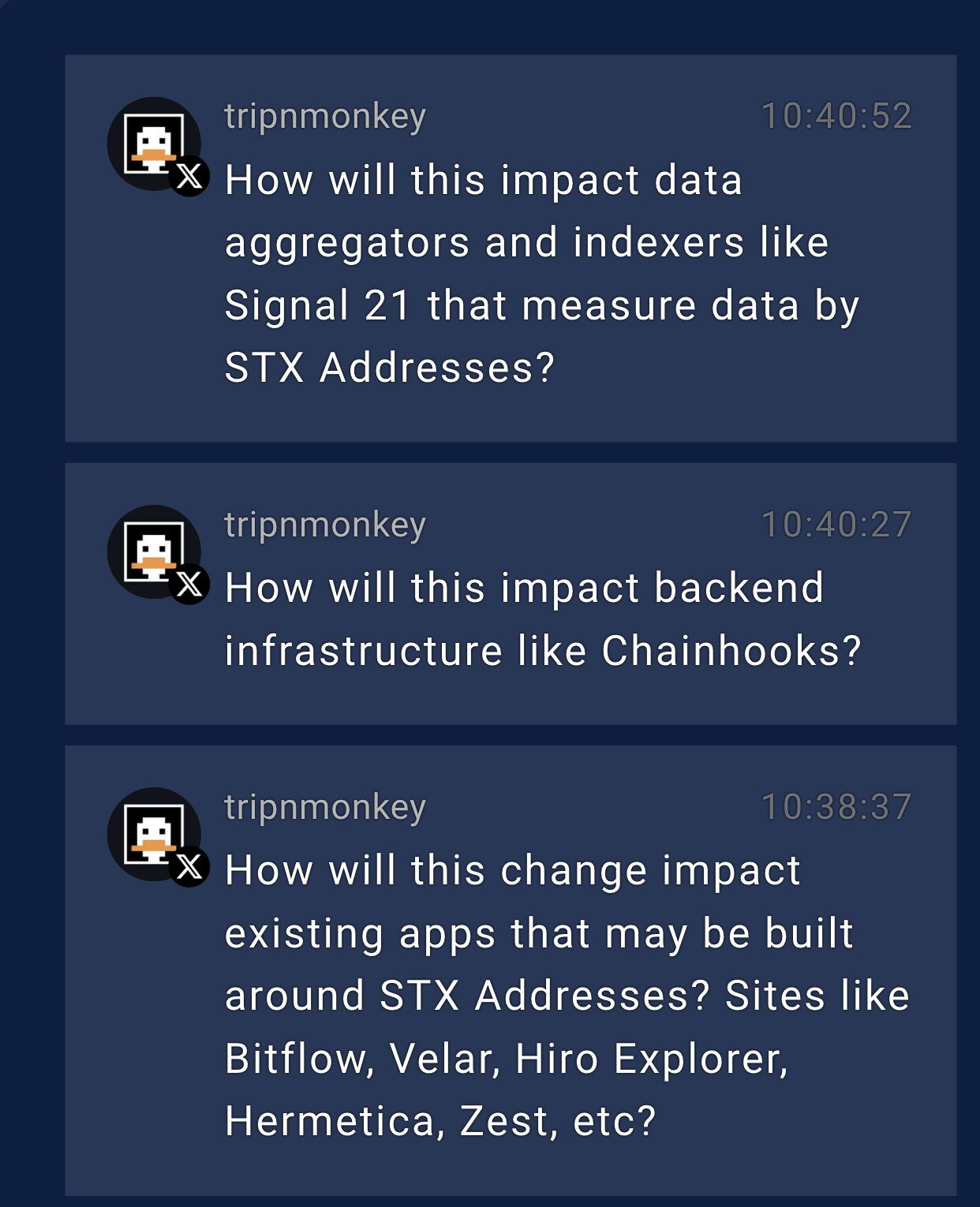

- Perception: If sBTC is viewed as a “representation” of BTC (similar to Lightning Network’s lnBTC), users may assume no taxable event occurs (Stacks FAQ).

- Reality: The IRS has not explicitly ruled on non-custodial L1→L2 transfers. However, because sBTC exists on a separate blockchain (Stacks), the IRS could argue that minting sBTC constitutes a disposition of BTC, triggering a taxable event.

Comparison to Other Solutions

- Lightning Network (LN): Moving BTC to LN is often seen as non-taxable because LN operates as a payment channel (not a new token).

- Ethereum’s wBTC: Custodial wrapping is taxable because it involves surrendering BTC for a new ERC-20 token.